Popular Case Studies from Cyclefund Research by Mark Cummings PhD

The purpose of this section is to present concise summaries and links to the first four applications of the Cyclefund Strategic Investment Framework, an extension of the original work presented in the doctoral thesis of Dr. Mark Cummings entitled The Strategic Games Model: An Entrepreneurial Approach to Competitive Strategy published in 1997 by Stanford University. The four case studies discussed are the 2016 Tesla Case Study, 2016 IBM Case Study, 2015 Google Case Study, and 2014 Apple Case Study, as listed below.

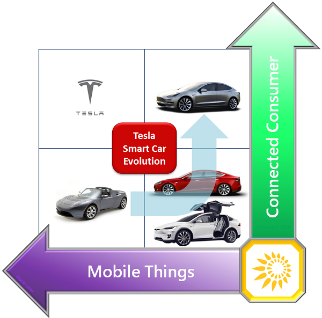

2016 Tesla Case Study: The AI-Assisted Smartcar Phase of the EoT Era

The 2016 Case Study on Tesla by Cyclefund Research examines the concept of a AI-assisted suite of semi-autonomous smartcars (smartcar suite) and how Tesla plans to leverage its core competencies in narrowly focused artificial intelligence (AI), global charging networks, and lithium-ion battery storage technologies to a) fundamentally redefine premium luxury and premium mass-market automobiles, b) provide integrated smartcar, smart home, and smart grid solutions to consumers and businesses, and c) capitalize on the accelerating global shift toward sustainable transport and sustainable energy in the emerging electrification of things (EoT) era. The 2016 Tesla Case Study is also available on the new mobile version of Cyclefund 2020.

2016 IBM Case Study: The Enterprise AI Era

The 2016 case study on IBM by Cyclefund Research examines the concept of a hybrid cloud-connected

suite of cognitive enterprise apps (cognitive suite) and how IBM plans to restructure its portfolio of hardware, software, and services assets to focus on its core competencies

in artificial intelligence (AI) and machine learning to establish a position of dominance in the emerging enterprise AI era. By doing so, the firm expects to transform the way in which humans and

machines work together to improve business performance across numerous industries, including

healthcare, commerce, finance, security, energy, transportation, and

education.

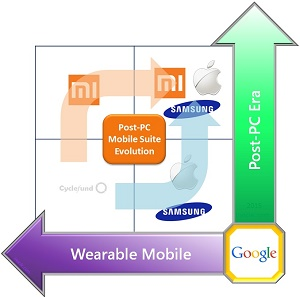

2015 Google Case Study: The Wearable Mobile Post-PC Era

The 2015 case study on Google by

Cyclefund Research introduces and examines the concept of a cloud-connected suite of smart wearable and non-wearable mobile devices (wearable mobile suite) and how

Google plans to capitalize on the success of emerging (Xiaomi and Huawei) and established (Samsung and Apple) post-PC smart device vendors to catapult itself into a dominant position in the nascent

wearable mobile post-PC era.

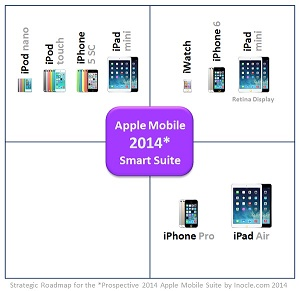

2014 Apple Case Study: The Mobile Post-PC Era

The 2014 case study on Apple by Cyclefund Research introduces and examines the concept of a

cloud-connected suite of smart mobile devices (mobile suite) and its fundamental role in shaping Apple's next big move to reestablish its dominant position in the maturing

mobile post-PC era after the firm lost its position of dominance following the release of the iPhone 5 in late 2012.

iFund Post-PC Technology Fund

In this section we employ the principles of the Cyclefund strategic investment framework to construct a set of concentrated and defensible technology portfolios specifically designed to capitalize on the five fundamental cycles driving consumer and business adoption of post-PC hardware devices, post-PC system software, post-PC application software, and post-PC cloud services. We organize these post-PC focused portfolios within a technology fund, which we refer to as the Inocle Post-PC Technology Fund, or iFund for short. Before we present the structure and core holdings of the iFund, we must first understand the five fundamental cycles that influence our strategic equity selection decisions, strategic entry and exit point decisions, and strategic asset allocation decisions.

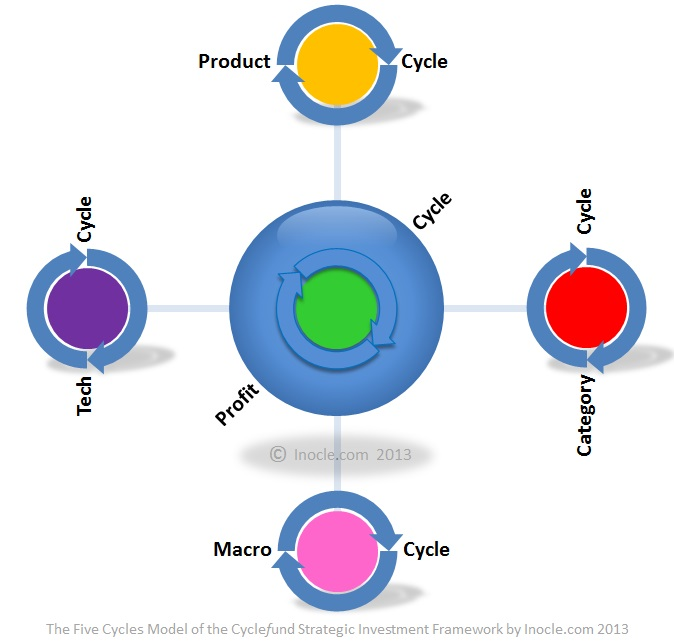

The Five Cycles Model of the Strategic Investment Framework

The dynamic systems model that underpins the Cyclefund strategic investment framework postulates the existence of five fundamental cycles that drive sustainable long-term investment returns for market-leading companies that through either superior strategic vision or pure happenstance are able to successfully capture and leverage the game-changing power of these five forces. The five fundamental cycles incorporated in the Cyclefund dynamic systems model are listed below as follows:

- Global macro cycle

- Global technology cycle

- Global category cycle

- Global product cycle

- Global profit cycle

The list above is organized according to cyclic periodicity, with long-period cycles listed at the top and the short-period cycles at the bottom. In general, macro cycles may run for multiple decades, technology cycles and category cycles for decades, product family cycles for several years, and profit cycles for several quarters. The five cycles are also organized graphically and illustrated visually in the five-cycles reference diagram below.

We call this diagram the Five Cycles Model of the Cyclefund Strategic Investment Framework. The cyclic forces generated by this model vary as a

function of spatial location and temporal period, and they serve as useful, powerful, and highly insightful geotemporal signals to guide investment selection, allocation,

and timing decisions in accordance with the Cyclefund strategic investment framework and the governance policies of the Inocle Fund, or iFund.

When the five cycles converge in time and space, a

discontinuous stochastic collision event we refer to as geotemporal cyclic

convergence, revolutionary, world-shaping, groundbreaking, game-changing, global-scale innovations are probabilistically more likely to occur. At these critical points in time and space,

market-leading companies with exactly the right hardware product innovations, software product innovations, and service product innovations, in exactly the right geographies around the world, at

exactly the right times, at exactly the right price points relative to competitors, with exactly the right volume to meet customer demand, and exactly the right supply chain cost structure are

uniquely positioned to deliver superior value to customers and in turn superior returns to investors.

iFund Central Objective

One of the greatest multigenerational global macro cycles of all time (rise of the global middle class) and one of the greatest generational global technology cycles (rise of the post-PC era) of all time are on the verge of converging with possibly the greatest global category cycle of all time (rise of the post-PC suite), producing massive customer value for middle class families around the world who embrace a multiscreen post-PC lifestyle, from nano-screen and micro-screen wearable mobile devices (such as Internet glasses and watches) to mini-screen and mid-screen non-wearable mobile devices (such as Internet media players, phones, and tablets) to large-screen and extreme-screen non-mobile devices (such as Internet televisions, high definition TVs, and Ultra HD TVs), and gravitate toward and adopt a non-complex, intuitive, optimized, and synchronized post-PC suite of solutions comprising seamlessly integrated post-PC devices, post-PC apps, and post-PC cloud services.

Given that we are about to witness unprecedented geotemporal cyclic convergence on a massive global scale, our central objective is to design a fund, referred to as the iFund, comprising a set of core, aggressive, and speculative post-PC technology portfolios strategically designed in accordance with the principles of the Cyclefund strategic investment framework, that enables investors worldwide to benefit from the next wave, make that tidal wave, in modern computing technology.

Optimal Post-PC Portfolio Structures

The first step in achieving the fund's central objective is to design an optimal set of post-PC technology portfolios that will enable us to capture a portion of the shareholder value generated by market-leading post-PC companies with superior strategic vision to be extraordinarily well positioned to benefit from the impending tidal wave effected by the geotemporal cyclic convergence predicted by the five cycles model of the strategic investment framework.

To construct portfolios optimized for the post-PC era, we begin by making the distinction between a post-PC portfolio class and post-PC portfolio instance. We define a post-PC portfolio class as a structured set of post-PC portfolio categories. We define a post-PC portfolio instance as a portfolio class structure fully or partially populated with post-PC companies. With these definitions at hand, we shall now present our optimized post-PC technology portfolio classes, or structures, in the remainder of this section, and we shall present our optimized post-PC technology portfolio instances, or simply portfolios, in subsequent sections.

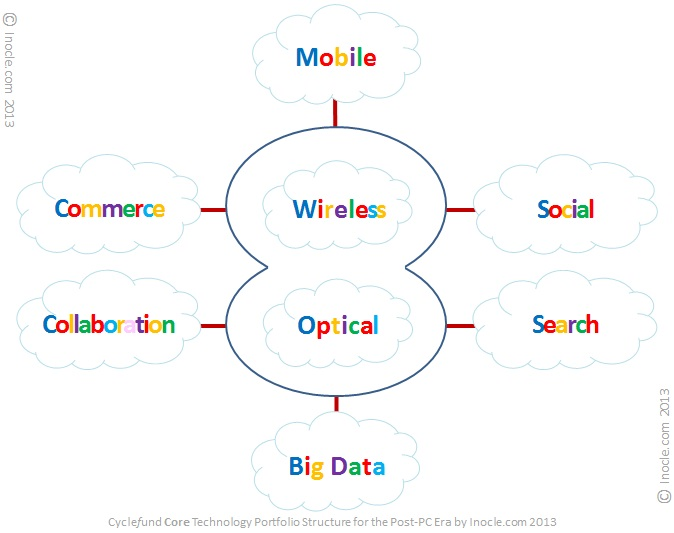

The following set of post-PC technology portfolio structures are optimized across core dimensions of performance, volatility, durability, and concentration. The first portfolio structure, shown in the diagram below, contains a semi-concentrated mix of core post-PC categories that are well established, experiencing moderate to rapid growth, and served by two or more durable competitors with market-leading positions.

We call the diagram above the Top-8 Categories of the Cyclefund Core Technology Portfolio Structure for the Post-PC Era. (This diagram is also referred to as the Cyclefund Lucky-8 Diagram, or L8D for short, as the shape of the dark blue core resembles the number eight, and the number of game-changing categories, as represented by light blue & white clouds, is precisely eight as well.) The top-eight categories depicted in the diagram, including mobile, commerce, wireless, social, collaboration or "cloud", optical, search, and big data, are each game-changing, or killer, post-PC categories individually. Collectively the top-8 post-PC categories of the core post-PC technology portfolio structure represent a powerful, established, semi-concentrated, and durable vehicle for capturing a significant portion of the upside value generated by market-leading post-PC companies.

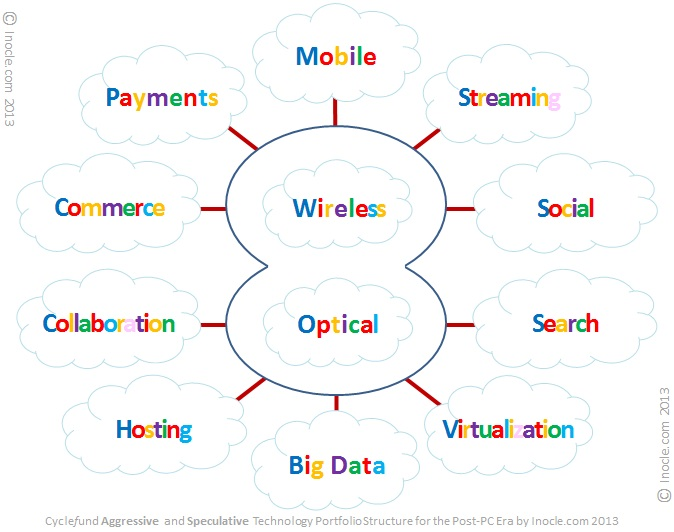

The second portfolio structure, shown in the diagram below, contains a less-concentrated mix of post-PC categories, some of which are less well established, experiencing extremely rapid but erratic growth, and served by less durable competitors with more tenuous market positions.

We call the diagram above the Top-12 Categories of the Cyclefund

Aggressive and Speculative Technology Portfolio Structure for the Post-PC Era. The top-twelve post-PC categories depicted in the diagram include the top-eight post-PC categories from the core

technology portfolio structure plus four additional categories: payments, streaming, hosting, and virtualization. These additional aggressive/speculative post-PC

categories are also each game-changing, or killer, post-PC categories individually. Collectively, the top-12 post-PC categories of the aggressive and speculative post-PC technology portfolio

structure represent a potentially more powerful, yet less well established, less concentrated, less durable, and more volatile vehicle for capturing upside value generated by market-leading post-PC

companies.

The Grand Master List of Post-PC Companies

Having constructed an optimized set of core and aggressive/speculative post-PC portfolio structures, we are one step closer to achieving the fund's central objective to design an optimal set of post-PC technology portfolio instances. Since, by definition a portfolio instance is a

portfolio structure populated with portfolio companies, the next logical step in our portfolio design process is to

fill the game-changing categories within our post-PC portfolio structures with market-leading post-PC companies.

Sounds simple. But, what are the market-leading post-PC companies? Is there a predefined master list? Moreover, even if a master list of post-PC

companies were readily available, how would one map companies on this list to the killer post-PC

categories of our post-PC portfolio structures? Luckily, most of the work has been done for us on the inocles.com website.

Core Post-PC List

By reviewing and extracting the core set of companies identified and discussed in the presentation of the Multidimensional Killer App & Cloud Service Framework

for the Post PC Era on the iPhone page of the inocles.com site, we are able to quickly generate the following list of post-PC companies that are candidates for incorporation into one or more

post-PC categories of our post-PC portfolio structures:

- Amazon.com

- Apple

- Dropbox

- Microsoft

- Netflix

- Salesforce.com

Cloud Service Post-PC List

Next, if we then extract all of the companies identified and discussed in the section entitled Killer Post-PC Cloud Services and Post-PC Cloud Companies on the Steve Jobs page of the

inocles.com site, we can quickly add the following additional post-PC companies to our master list:

- Accenture

- Activision

- Acxiom

- Adobe

- AT&T

- Baidu

- Box

- Cerner

- Electronic Arts

- EMC

- Groupon

- Guidewire

- IBM

- Infosys

- NetSuite

- Oracle

- Pandora

- PayPal unit of eBay

- Priceline.com

- Rackspace

- Red Hat

- SAP

- Sina

- Splunk

- Square

- Teradata

- Verizon

- VMware

- Vodafone

- Workday

- Yahoo

- Yelp

- Zillow

Value Chain Ecosystem Post-PC List

Lastly, if we do the same for all of the relevant companies identified and discussed in the section entitled Defining the Global Value Chain Ecosystem for the

Post-PC Era on the iPad page of the inocles.com site, we can add even more post-PC companies to our master list:

- Akamai

- Altera

- America Movil

- American Tower

- ARM Holdings

- Best Buy

- Bharti Airtel

- BlackBerry

- Broadcom

- BT Group

- CBS

- China Mobile

- Cisco Systems

- Comcast

- Corning

- Deutsche Telekom

- Disney

- Ericsson

- Foxconn

- Gogo

- HTC

- Huawei

- Intel

- Lenovo

- Micron

- Motorola

- Nippon Telegraph and Telephone

- Nokia

- NTT Docomo

- Nvidia

- NXP Semiconductors

- Orange

- Qualcomm

- Samsung

- SanDisk

- SoftBank

- Sony

- Staples

- Taiwan Semiconductor Manufacturing

- Telefonica

- Telstra

- Tesla

- Texas Instruments

- Time Warner

- Twenty-First Century Fox

- Xilinx

- ZTE

By combining all of the post-PC companies identified in the three separate lists above, we now have a grand total of 90 post-PC companies to filter and slot into the post-PC categories of our post-PC portfolio structures. Armed with this new grand master list of post-PC companies, we are well prepared to proceed to the next phase of the portfolio design process.

The next phase of our portfolio design process involves identifying and selecting the very best companies from the grand master list of post-PC companies to incorporate into the following set of Cyclefund post-PC portfolios:

- Cyclefund Core Post-PC Technology Portfolio

- Cyclefund Aggressive Post-PC Technology Portfolio

- Cyclefund Speculative Post-PC Technology Portfolio

We shall also include two additional special-case post-PC portfolios for consideration:

- Cyclefund Global-Liquidation-Event (GLE) Post-PC Technology Portfolio

- Cyclefund Deep Global-Liquidation-Event (Deep-GLE) Post-PC Technology Portfolio

The Cyclefund GLE and deep-GLE portfolios are referred to as special-case portfolios because they are to be invoked only in the event of a massive all-asset-class exodus to liquidity.

Core Post-PC Portfolio

In this section we identify and select the optimal post-PC companies for the Cyclefund core technology portfolio. To do so, we first list the categories, or slots, defined by the core technology portfolio class. Then for each slot we review our grand master list of post-PC companies presented previously to identify the relevant subset of slot-specific post-PC candidate companies, which we subsequently examine and evaluate in depth in order to select the very best, or optimal, candidate company for the individual slot, subject to iFund concentration and durability governance rules, as well as iFund volatility constraints and performance objectives.

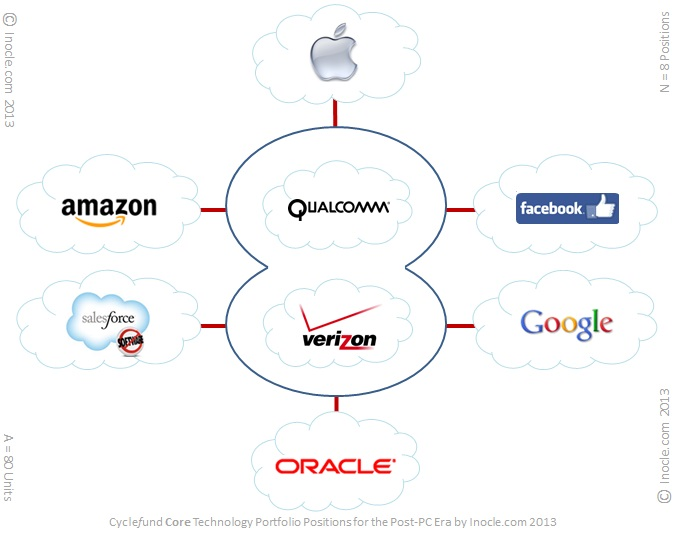

We repeat this evaluation process sequentially for each of the remaining slots in the core technology portfolio structure, and after all slots have been evaluated and filled with optimal candidate companies, we summarize our results in a structured portfolio list as follows:

- Mobile post-PC category: Apple

- Commerce post-PC category: Amazon

- Wireless post-PC category: Qualcomm

- Social post-PC category: Facebook

- Collaboration post-PC category: Salesforce.com

- Optical post-PC category: Verizon

- Search post-PC category: Google

- Big Data post-PC category: Oracle

Each of the eight items in the structured core technology portfolio list above contains a single killer post-PC category followed by the optimal post-PC candidate company for that particular category. Moreover, for purposes of clarity and brevity, we refer to the optimal post-PC candidate company for a particular slot as the top slot-specific post-PC company, or simply top post-PC company for short, with the slot-specific context implied.

With this structured portfolio list in hand, we can now graphically organize our top post-PC companies into a simple, powerful, and intuitive visual representation of the core technology portfolio, as shown in the diagram below.

We refer to the diagram above as the Top-8 Holdings of the Cyclefund Core Technology Portfolio for the

Post-PC Era. Each of the top-eight post-PC holdings depicted in the diagram represents an active investment with non-zero allocation within the actively managed Cyclefund core technology

portfolio for the post-PC era. (Once a top post-PC

company is assigned a specific number of allocation units from iFund reserves and purchased in the open or private equity markets, it is redesignated as a top post-PC holding,

signifying that it is an active investment holding with non-zero allocation within one or more actively managed Cyclefund portfolios.)

Each core post-PC holding was selected from the grand master list of post-PC

companies based on its current or expected future market-leading position in its respective post-PC category, as well as its compliance with iFund performance objectives and volatility, durability,

and concentration risk constraints.

Aggressive Post-PC Portfolio

In this section we identify and select the optimal post-PC companies for the Cyclefund aggressive technology portfolio. The twelve killer categories defined by the aggressive technology portfolio class are listed below as follows:

- Mobile post-PC category

- Payments post-PC category

- Streaming post-PC category

- Commerce post-PC category

- Wireless post-PC category

- Social post-PC category

- Collaboration post-PC category

- Optical post-PC category

- Search post-PC category

- Hosting post-PC category

- Virtualization post-PC category

- Big Data post-PC category

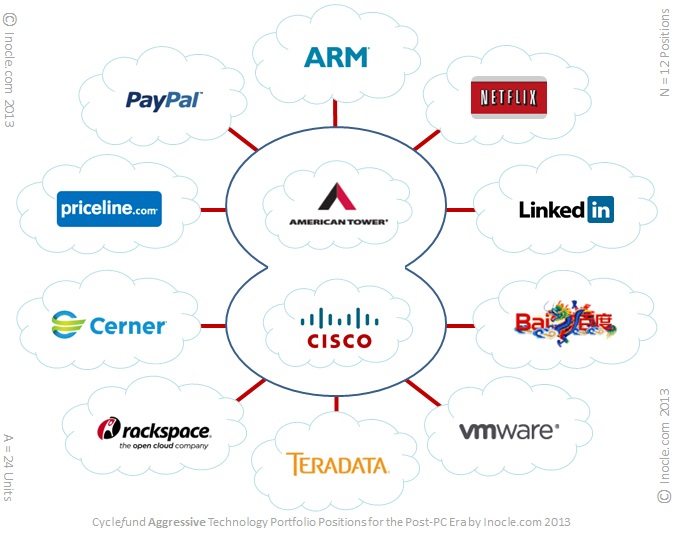

For each category above, we review the grand master list of post-PC companies presented previously and identify, evaluate, and select the optimal post-PC candidate company subject to iFund performance objectives and volatility, concentration, and durability risk constraints, as described previously. We then summarize our results in a structured portfolio list as follows:

- Mobile post-PC category: ARM Holdings

- Payments post-PC category: eBay (PayPal)

- Streaming post-PC category: Netflix

- Commerce post-PC category: Priceline.com

- Wireless post-PC category: American Tower

- Social post-PC category: LinkedIn

- Collaboration post-PC category: Cerner

- Optical post-PC category: Cisco Systems

- Search post-PC category: Baidu

- Hosting post-PC category: Rackspace

- Virtualization post-PC category: VMware

- Big Data post-PC category: Teradata

Each of the twelve items in the structured

aggressive technology portfolio list above contains a single killer post-PC category followed by the top post-PC company for that particular category.

With this

structured portfolio list in hand, we can now graphically organize our top post-PC companies into a simple, powerful, and

intuitive visual representation of the aggressive technology portfolio, as shown in the diagram below.

We refer to the diagram above as the Top-12 Holdings of the Cyclefund Aggressive Technology Portfolio

for the Post-PC Era. Each of the top-twelve post-PC

holdings depicted in the diagram represents an active investment with non-zero allocation within the actively managed

Cyclefund aggressive technology portfolio for the post-PC era.

Each aggressive post-PC holding was selected from the grand master list of post-PC companies based on its current or expected future market-leading position in its

respective post-PC category, as well as its compliance with iFund performance objectives and volatility, durability, and concentration risk constraints.

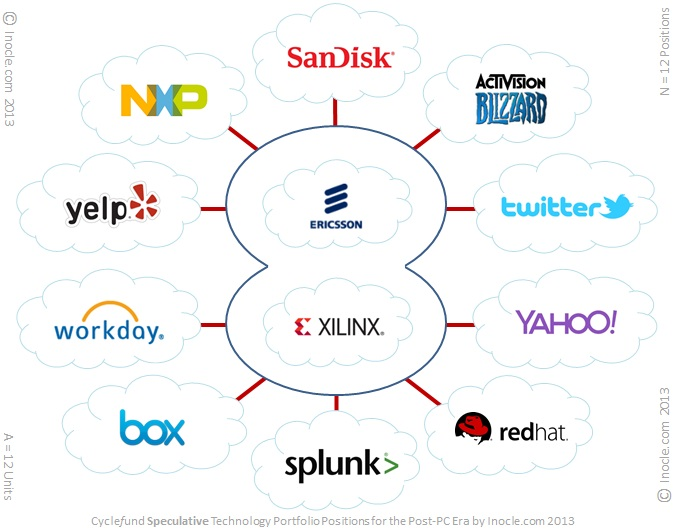

Speculative Post-PC Portfolio

In this section we identify and select the optimal post-PC companies for the Cyclefund speculative technology portfolio. The killer categories defined by the speculative technology portfolio class are identical to those defined by the aggressive technology portfolio class presented in the previous

section.

For each killer category defined by the speculative technology portfolio class, we review the grand master list of post-PC companies presented previously and

identify, evaluate, and select the optimal post-PC candidate company subject to iFund performance objectives and volatility, concentration, and durability risk constraints, as described

previously. We then summarize our results in a structured portfolio list as follows:

- Mobile post-PC category: SanDisk

- Payments post-PC category: NXP Semiconductor

- Streaming post-PC category: Activision

- Commerce post-PC category: Yelp

- Wireless post-PC category: Ericsson

- Social post-PC category: Twitter

- Collaboration post-PC category: Workday

- Optical post-PC category: Xlinx

- Search post-PC category: Yahoo

- Hosting post-PC category: Box

- Virtualization post-PC category: Red Hat

- Big Data post-PC category: Splunk

Each of the twelve items in the structured

speculative technology portfolio list above contains a single killer post-PC category followed by the top post-PC company for that particular category.

With this

structured portfolio list in hand, we can now graphically organize our top post-PC companies into a simple, powerful, and intuitive visual representation of the speculative technology

portfolio, as shown in the diagram below.

We refer to the diagram above as the Top-12 Active or Potential Holdings of the Cyclefund Speculative

Technology Portfolio for the Post-PC Era. Each of the

top-twelve post-PC companies depicted in the diagram is either a potential speculative holding with zero

allocation or an active speculative holding with non-zero allocation within the actively managed Cyclefund speculative technology portfolio for the post-PC era.

Each speculative post-PC potential or active holding was selected from the grand master list of post-PC companies based on its current or expected future market-leading

position in its respective post-PC category, as well as its compliance with iFund performance objectives and volatility, durability, and concentration risk

constraints.

Global Liquidation Event Risks

In the preceding sections we defined and designed a set of core, aggressive, and speculative post-PC technology portfolios to capitalize on

shareholder value generated by market-leading post-PC companies. Our structured post-PC portfolios enable investors to benefit significantly from post-PC technology

cycles, post-PC category cycles, post-PC product cycles, and post-PC profit cycles assuming a stable foundational macro cycle. But what happens when the underlying

macro cycle turns against you? Against all investors? When market volatility spikes and equity values plummet

precipitously? As a technology investor, what do you do under these high-risk, capital-crushing circumstances?

In this section we specifically address the last question above by introducing a new set of iFund governance rules, called liquidation-event risk constraints. These new liquidation event

constraints specify absolute limits on

portfolio allocation levels, number of portfolio holdings, and holding bankruptcy probabilities in the special case of an all-asset-class investor exodus to liquidity on a massive global scale. We refer to this massive flight from

capital as as a global liquidation event, or GLE for short. In recent times, GLEs are no longer uncommon, as we have seen in 2000, 2008, and to a lesser degree in the summer

of 2011. Given that the frequency of GLEs may be increasing rather than decreasing, it is only prudent to consider all available strategies and techniques to protect one's financial assets during

sharp, violent, and in some cases protracted market resets.

There are a variety of approaches for minimizing the risk of financial loss under adverse global market conditions. Investors may choose to reduce risk by hedging their long equity positions with

call options on volatility, put options on one or

more domestic or international market indices, or outright purchases of one or more leveraged and inversely-correlated exchange

traded funds. These and other more complex hedging approaches are clearly valid risk reduction strategies, and sophisticated high-net worth investors should consider such strategies and techniques

under the guidance of their certified financial advisor.

We shall, however, employ a more traditional, but no less effective, old-school risk mitigation strategy, which is to go to cash with a non-trivial portion of one's holdings by

reducing position count, allocation levels, and volatility levels within and across the set of active portfolios. The best way to do this efficiently and quickly is to have a predefined set of

portfolio structures and corresponding portfolio instances to invoke upon the occurrence of a GLE or deep GLE. We shall present our predefined GLE and deep-GLE portfolio structures and portfolio

instances in the next sections.

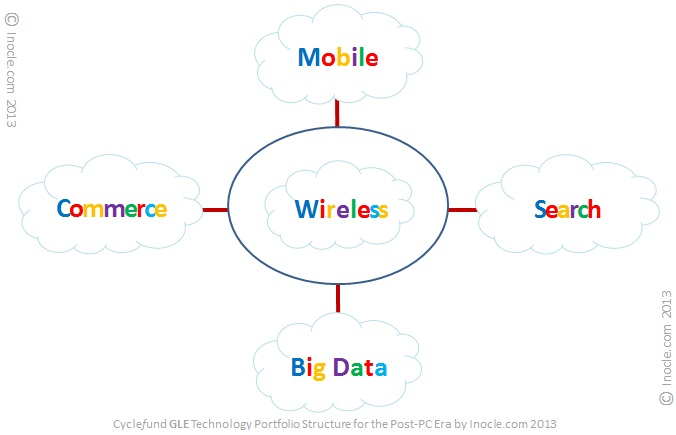

Liquidation Event Post-PC Portfolio

Structures

In this section we present two post-PC portfolio structures to be utilized only in the special case of a global liquidation event, the first in the case of a moderate

GLE occurrence and the second in the case of a deep GLE occurrence. The first moderate GLE post-PC portfolio structure, shown in the diagram below, contains a highly-concentrated mix of core

post-PC categories that are well established pre-GLE and likely to continue be well established post-GLE, likely to see growth curtailed during the GLE but not post-GLE, and unlikely to contain

companies experiencing mass layoffs during the GLE or post-GLE.

We call the diagram above the Top-5 Categories of the Cyclefund Global Liquidation Event (GLE) Technology Portfolio Structure for the Post-PC Era. The top-five categories depicted in the diagram include mobile, commerce, wireless, search, and big data. The GLE post-PC technology portfolio structure represents a concentrated vehicle spanning five post-PC categories of well-established and highly durable post-PC companies with strong post-GLE growth potential.

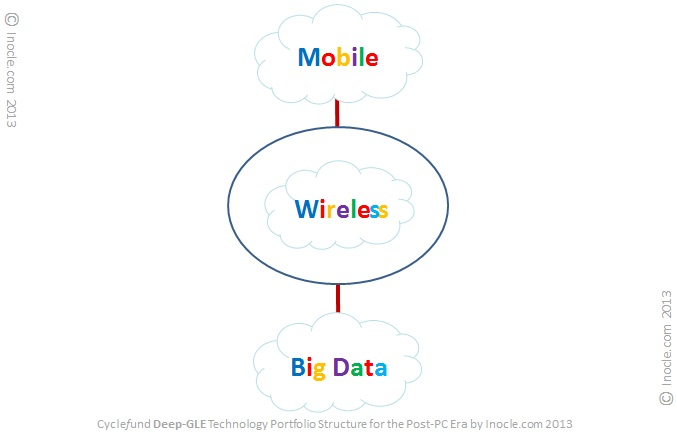

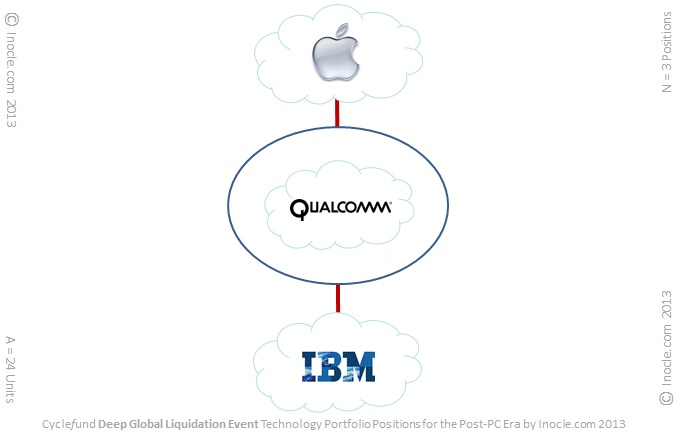

The second deep-GLE post-PC portfolio structure, shown in the diagram below, contains a massively-concentrated mix of core post-PC categories that are firmly entrenched worldwide pre-GLE and likely to remain firmly entrenched globally post-GLE, likely to see declining revenues during the GLE but not post-GLE, and unlikely to contain companies experiencing bankruptcy during the GLE or post-GLE.

We call the diagram above the Top-3 Categories of the Cyclefund Deep Global Liquidation Event (Deep-GLE) Technology Portfolio Structure for the Post-PC

Era. The top-three categories depicted in the diagram include

mobile, wireless, and big

data. The deep-GLE post-PC technology

portfolio structure represents a highly-concentrated vehicle spanning three post-PC categories of firmly entrenched post-PC companies unlikely to experience

bankruptcy.

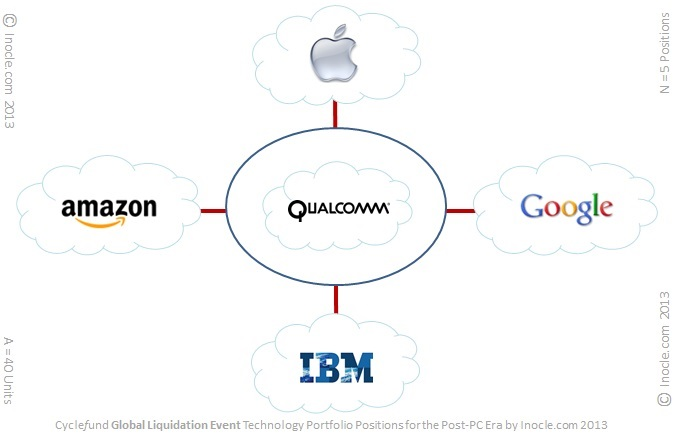

Global Liquidation Event Post-PC Portfolio

In this section we identify and select the optimal post-PC companies for the Cyclefund GLE technology

portfolio.

First, we list the five killer categories defined by the GLE technology portfolio class as

follows:

- Mobile post-PC category

- Commerce post-PC category

- Wireless post-PC category

- Search post-PC category

- Big Data post-PC category

Then for each category above, we select the optimal post-PC company from our grand master list of post-PC companies subject to iFund performance objectives and volatility, concentration, and durability risk constraints, as described previously, as well as our new global liquidation-event risk constraint. Next, we summarize our results in a structured portfolio list as follows:

- Mobile post-PC category: Apple

- Commerce post-PC category: Amazon.com

- Wireless post-PC category: Qualcomm

- Search post-PC category: Google

- Big Data post-PC category: IBM

Each of the five items in the structured GLE

technology portfolio list above contains a single killer post-PC category followed by the top post-PC company for that particular category.

With this

structured portfolio list in hand, we can now graphically organize our top post-PC companies into a simple and insightful visual representation of the GLE technology portfolio, as shown in the

diagram below.

We refer to the diagram above as the Top-5 Conditional Holdings of the Cyclefund Global

Liquidation Event (GLE) Technology Portfolio for the Post-PC

Era.

Each of the top-five post-PC companies depicted in the diagram represents a

conditional post-PC holding, which becomes an active post-PC

holding with non-zero allocation within the actively managed

Cyclefund GLE post-PC technology portfolio under the special condition of an expected GLE occurrence, ongoing GLE occurrence, or post-GLE

recovery.

Each conditional post-PC holding was selected from the grand master list of post-PC

companies based on its current or expected future market-leading position in its respective post-PC category, as well as its compliance with iFund performance objectives and volatility, durability,

concentration, and liquidation-event risk constraints.

Deep Global Liquidation Event Post-PC Portfolio

In this section we identify and select the optimal post-PC companies for the Cyclefund Deep-GLE technology

portfolio.

First, we list the three killer categories defined by the Deep-GLE technology portfolio class as

follows:

- Mobile post-PC category

- Wireless post-PC category

- Big Data post-PC category

Then for each category above, we select the optimal post-PC company from our grand master list of post-PC companies subject to iFund performance objectives and volatility, concentration, and durability risk constraints, as described previously, as well as our new global liquidation-event risk constraint. Next, we summarize our results in a structured portfolio list, as follows:

- Mobile post-PC category: Apple

- Wireless post-PC category: Qualcomm

- Big Data post-PC category: IBM

Each of the three items in the structured GLE

technology portfolio list above contains a single killer post-PC category followed by the top post-PC company for that particular category.

With this structured portfolio list in hand, we can now graphically organize our top post-PC companies into a very simple yet still insightful visual representation of the Deep-GLE

technology portfolio, as shown in the diagram

below.

We refer to the diagram above as the Top-3 Conditional Holdings of the Cyclefund Deep

Global Liquidation Event (Deep-GLE) Technology Portfolio for the Post-PC

Era.

Each of the top-three post-PC companies depicted in the

diagram represents a conditional post-PC holding, which becomes

an active post-PC

holding with non-zero allocation within the actively managed

Cyclefund deep-GLE technology portfolio under the special condition of an expected deep-GLE occurrence, ongoing deep-GLE occurrence, or post-GLE

recovery.

Each conditional post-PC holding

was selected from the grand master list of post-PC companies based on its current or expected future market-leading position in its respective post-PC category, as well as its

compliance with iFund performance objectives and volatility, durability, concentration, and liquidation-event risk constraints.

Global Surge Event and GSE Risks

In the previous sections we discussed the important concept of a global liquidation event (GLE), which represents an all-asset-class investor exodus to liquidity on a massive global scale. We noted

that exposure to technology investments must be reduced quickly and dramatically prior to or at the onset of a GLE or Deep GLE, and we

presented portfolio structures and instances specifically designed for such

conditions. With the concept of a GLE firmly under our belt, we are now in position to consider a new

and equally important concept, called a global surge event (GSE).

A GSE is conceptually the exact opposite of a GLE. In contrast to a global liquidation event where investors irrationally flee risk

assets, investors irrationally seek risk assets during a global surge event. Moreover,

unlike a GLE which is commonly driven by a highly adverse macro cycle, a GSE is typically driven by a favorable macro cycle coupled with highly favorable technology and category cycles. Lastly, while

GLEs trigger irrationally massive selling waves and concomitant hyperbolic price declines, GSEs trigger irrationally massive buying waves and concomitant hyperbolic prices surges, hence the

name global surge event.

By specifically applying the concept of a global surge event to technology investing, we can define a technology GSE, or tech GSE, as a relatively small window in time where global

technology investors actively and aggressively increase their exposure to technology assets en masse, thereby

fueling sustained and abnormally large technology buying waves and concomitant hyperbolic surges in technology equity prices. In short, tech GSEs have the power to drive hyperbolic moves in

technology stocks.

Since GSEs in general and tech GSEs specifically are associated with hyperbolic price movements on the way up and also typically with mirror-image hyperbolic price movements on the way back down,

GSEs are inherently very risky. Investors must exercise extreme caution during periods in and around global surge events. In particular, investors must avoid pre-surge, surge, and post-surge

risk by not being positioned short going into a GSE move, not entering into or adding to a long position late in a GSE move, and not stubbornly sticking with a long position on the way back

down post GSE climax, for example.

With the tech GSE concept defined and GSE risks highlighted, the question now becomes: "How can post-PC technology investors ultimately benefit from a tech GSE?" This is a key question that

we shall answer in the next section.

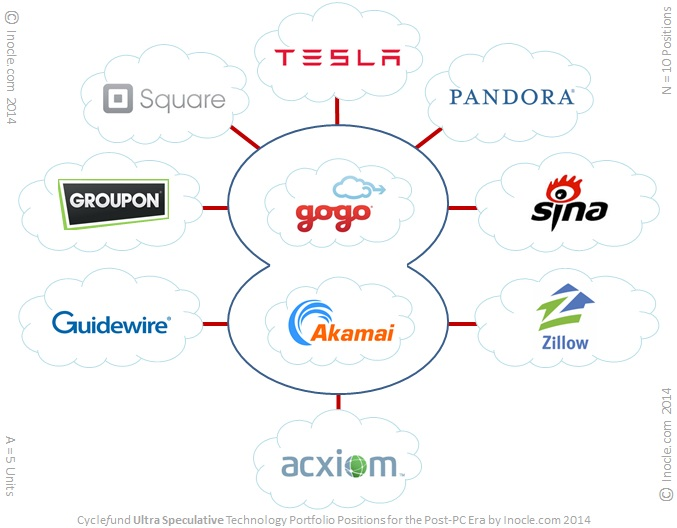

Ultra Speculative Post-PC

Portfolio

In this section we identify and select the optimal post-PC companies for the

Cyclefund ultra speculative technology

portfolio, a post-PC portfolio specifically designed to benefit from the special case of a global

surge event (GSE). The ten game-changing categories which constitute the ultra speculative technology

portfolio class are a subset of those defined by the aggressive and speculative technology portfolio class

presented previously, and they are listed below as

follows:

- Mobile post-PC category

- Payments post-PC category

- Streaming post-PC category

- Commerce post-PC category

- Wireless post-PC category

- Social post-PC category

- Collaboration post-PC category

- Optical post-PC category

- Search post-PC category

- Big Data post-PC category

For each category above, we leverage the grand master list of post-PC companies presented previously and identify, evaluate, and select the optimal post-PC candidate company subject to iFund performance objectives and volatility, concentration, durability, and surge risk constraints. The result of this process is the structured portfolio list below:

- Mobile post-PC category: Tesla

- Payments post-PC category: Square

- Streaming post-PC category: Pandora

- Commerce post-PC category: Groupon

- Wireless post-PC category: Gogo

- Social post-PC category: Sina

- Collaboration post-PC category: Guidewire

- Optical post-PC category: Akamai

- Search post-PC category: Zillow

- Big Data post-PC category: Acxiom

Each of the ten items in the structured ultra speculative technology portfolio list above

contains a single game-changing post-PC category followed by the top post-PC company for that particular category.

With this structured portfolio list in hand, we can now graphically organize our top post-PC companies into an insightful visual representation of the ultra speculative technology portfolio, as shown

in the diagram below.

We refer to the diagram above as the Top-10 Active or Potential Holdings of the

Cyclefund Ultra Speculative Technology Portfolio for the Post-PC

Era. Each of the top-ten post-PC companies depicted in the diagram is either a potential ultra speculative holding with zero allocation or an active ultra speculative holding with non-zero allocation within the actively managed Cyclefund

ultra speculative technology portfolio for the post-PC era.

Each ultra speculative post-PC potential or active holding was selected from the grand master list of post-PC companies based on its current or expected future

market-leading position in its respective post-PC category, as well as its compliance with iFund performance objectives and volatility, durability, concentration, and surge risk constraints.

Risk Management of an Ultra Speculative Post-PC Portfolio

Because of the inherent risks associated with the Cyclefund ultra speculative post-PC portfolio in general and during and immediately following global surge events in particular, the

aggregate portfolio itself as well as each of its individual holdings must be carefully monitored from a risk management perspective, with specific emphasis placed on surge and post-surge

risks.

For example, a post-PC investor should explicitly avoid establishing or adding to a long position in an individual holding within an ultra speculative post-PC portfolio that is probabilistically in

the late stages of a global surge event cycle. Moreover, and more critically, a post-PC investor should explicitly avoid over exposure to a long position in an individual holding within an ultra

speculative post-PC portfolio that is probabilistically in the post-climax stages of a GSE cycle.

Lastly, in the case of synchronous GSE, where the majority of categories or all categories constituting the fundamental structure of an ultra speculative post-PC portfolio simultaneously

experience the effects of a compound (or joint) global surge event, a post-PC investor should a) explicitly avoid committing any new capital to an ultra speculative post-PC portfolio

that, in aggregate, is probabilistically in the late stages of a joint global surge event cycle and b) rapidly reduce exposure to an ultra speculative post-PC portfolio that, in

aggregate, is probabilistically in the post-climax stages of a joint GSE cycle.

The risk management guidelines and examples described above for the Cyclefund ultra speculative post-PC portfolio also apply directly to the Cyclefund speculative, aggressive, and

core post-PC portfolios.

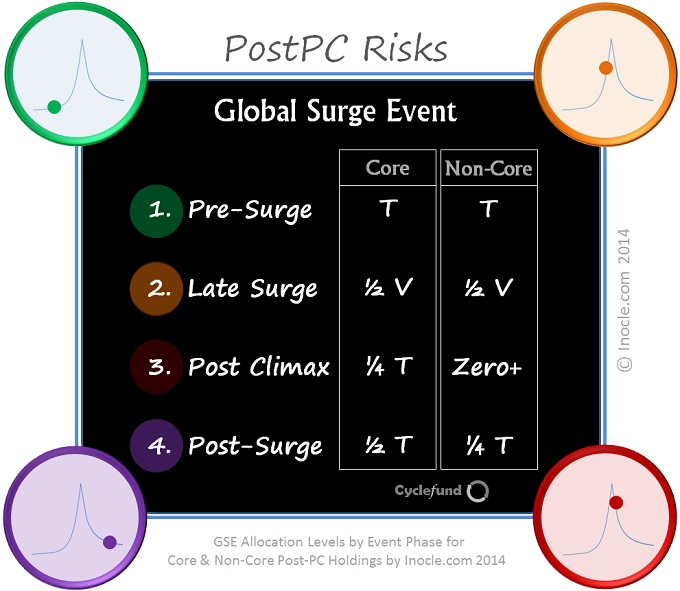

Quantum-Level Post-PC Risk Management Framework

The previous section qualitatively discussed risk management of a post-PC technology portfolio in the context of a global surge event

(GSE)

and a joint global surge event (Joint GSE). This section quantitatively expands on the

previous discussion.

Specifically, a risk management framework for establishing quantifiable capital allocation targets of a post-PC technology portfolio under global surge event and joint global surge event conditions

is presented. The core structure and symbolic rules of the framework are organized, illustrated, and summarized in the visual post-PC risk management diagram

below.

The diagram is formally referred to as the Cyclefund Post-PC Technology Portfolio

Quantum-Level Risk Management Framework for Global Surge Event and Joint Global Surge Event Conditions. Informally it is called the Post-PC Risk Management Framework. It is structurally

organized along two core dimensions: a) global surge event lifecycle phase, with discrete values pre-surge, late surge, post climax, and post-surge and b)

portfolio classification level, with discrete values core portfolio and non-core portfolios, which include aggressive, speculative, and ultra speculative portfolios.

The resulting eight-cell matrix formed by the intersection of the discrete values of these two core dimensions constitutes the fundamental lattice structure of the risk management framework. Each

intersection point within the lattice of the framework contains a simple conditional risk management rule for establishing the proposed conditional capital allocation level of a specific

holding under a global surge event and a group of correlated holdings under a joint GSE.

Simple Risk Management Rules for Core Post-PC Positions

As seen by reading the visual diagram above from top to bottom along the surge

dimension

while holding the classification dimension constant at the discrete value of

core,

the proposed conditional allocation levels for a specific core holding experiencing a GSE and for an aggregated group of correlated core holdings collectively experiencing a Joint GSE are governed by

the conditional risk management rules as

follows:

- Rule 1: In the Pre-Surge phase, set Allocation (A) to 100% of Target (T)

- Rule 2: In the Late-Surge phase, set Allocation to 50% of Value (V)

- Rule 3: In the Post-Climax phase, set Allocation to 25% of Target

- Rule 4: In the Post-Surge phase, set Allocation to 50% of Target

The four symbolic core risk management rules (Rule 1, Rule 2, Rule 3, and Rule 4) defined

above for each surge phase condition (Pre-Surge, Late-Surge, Post-Climax, and Post-Surge) are formulated using mathematical combinations of output and input

variables,

quantized numerical

parameters,

and stochastic random

variables.

The core output variable Allocation, symbolized by the letter A in the

written rules above, represents the proposed

conditional

capital allocation level for an individual core holding experiencing a GSE or an aggregated group of correlated core holdings experiencing a Joint GSE. The core parametric values, depicted by

percentages (100%, 50%, 25%, and 50%) in the written rules above and fractions (1, 1/2, 1/4, and 1/2) in the core classification column of the visual diagram above, represent numerical constants that

govern the relationship between core deterministic and stochastic input variables and core conditional stochastic output variables. Core parametric values are discretely quantized in constant

increments of 25 percent.

The core input variable Target, symbolized by the letter T in the written rules and visual diagram above, represents the pre-established target capital allocation level assigned to

a core holding within the Cyclefund core post-PC technology portfolio when the post-PC risk management framework is employed to the manage the risk associated with an individual core post-PC

equity position experiencing a GSE. It represents the pre-established total target capital allocation level assigned to an aggregated group of correlated core holdings within the Cyclefund

core post-PC portfolio when the risk framework is used to manage the risk associated with a group of correlated core post-PC equity positions experiencing a Joint GSE.

Similarly, the core stochastic random variable Value, symbolized by the letter V in the visual diagram above, represents the actual real-time equity market value of a core

holding

within the Cyclefund core post-PC

portfolio

when the framework is used to manage risk associated with an individual core post-PC equity

position experiencing a GSE. It represents the total actual real-time equity market value of a group of correlated core holdings within the Cyclefund core post-PC portfolio when the framework is used

to manage risk associated with an aggregated group of correlated core post-PC equity positions experiencing a Joint

GSE.

Lastly, the surge and classification dimensions that constitute the fundamental structure

of the risk management framework are discrete stochastic and discrete deterministic variables, respectively. The former is established by the state of an individual stock market equity in the case of

a GSE and an aggregated group of correlated stock market equities in the case of a Joint GSE. The latter is established by the portfolio classification level of an individual equity for a GSE and a

group of equities for a Joint GSE.

Simple Risk Management Rules for Non-Core Post-PC

Positions

As seen by reading the visual diagram above from top to bottom along the surge dimension

while holding the classification dimension constant at the discrete value of non-core, the proposed conditional allocation levels for a specific non-core holding

(aggressive

holding, speculative holding, or ultra-speculative

holding)

experiencing a GSE and for an aggregated group of correlated non-core holdings collectively experiencing a Joint GSE are governed by the conditional risk management rules as

follows:

- Rule 5: In the Pre-Surge phase, set Allocation to 100% of Target

- Rule 6: In the Late-Surge phase, set Allocation to 50% of Value

- Rule 7: In the Post-Climax phase, set Allocation to 0% of Target

- Rule 8: In the Post-Surge phase, set Allocation to 25% of Target

The four symbolic non-core risk management rules (Rule 5, Rule 6, Rule 7, and Rule 8)

defined above for each surge phase condition (Pre-Surge, Late-Surge, Post-Climax, and Post-Surge) are formulated using mathematical combinations of output and input variables, quantized numerical

parameters, and stochastic random variables.

The non-core output variable Allocation represents the proposed conditional capital allocation level for an individual non-core (aggressive, speculative, or ultra speculative) holding

experiencing a GSE or an aggregated group of correlated non-core holdings experiencing a Joint GSE. The non-core parametric values, depicted by percentages (100%, 50%, 0%, and 25%) in the written

rules above and fractions (1, 1/2, 0, and 1/4) in the non-core classification column of the visual diagram above, represent numerical constants that govern the relationship between non-core

deterministic and stochastic input variables and non-core conditional stochastic output variables. Non-core parametric values are discretely quantized in constant increments of 25 percent.

The non-core input variable Target, symbolized by the letter T in the visual diagram above, represents the pre-established target capital allocation level assigned to a non-core

(aggressive, speculative, or ultra speculative) holding within a Cyclefund aggressive, speculative, or ultra speculative post-PC technology portfolio when the post-PC risk management

framework is employed to manage the risk associated with an individual non-core post-PC equity position experiencing a GSE. It represents the pre-established total target capital allocation level

assigned to an aggregated group of correlated holdings within one or more Cyclefund non-core post-PC portfolios when the risk framework is used to manage the risk associated with a group of

correlated non-core post-PC equity positions experiencing a Joint GSE.

Similarly, the non-core stochastic random variable Value, symbolized by the letter V in the visual diagram above, represents the actual real-time equity market value of a non-core

(aggressive, speculative, or ultra speculative) holding within a Cyclefund non-core post-PC portfolio when the framework is used to manage risk associated with an individual non-core post-PC equity

position experiencing a GSE. It represents the total actual real-time equity market value of an aggregated group of correlated core holdings within the Cyclefund core post-PC portfolio when the

framework is used to manage risk associated with a group of correlated core post-PC equity positions experiencing a Joint GSE.

Lastly, the visual diagram representing the post-PC risk management framework contains four embedded illustrations depicting the temporal price trajectory and approximate lifecycle state of a generic

technology equity position experiencing a global surge event (GSE) and an aggregated group of correlated generic technology equity positions experiencing a joint global surge event (Joint GSE).

Specifically, the upper left-hand illustration (highlighted in a green circle) depicts the approximate lifecycle state (shown as a green dot) of a generic technology equity position experiencing the

calm pre-surge phase of a GSE or aggregated group of generic technology equity positions experiencing the pre-surge phase of a Joint GSE. The upper right-hand illustration (highlighted in

gold circle) depicts the approximate state (shown as a gold dot) of a tech position or group of tech positions experiencing the explosive late-surge phase of a GSE and Joint GSE,

respectively. The lower right-hand illustration (red circle) depicts the approximate state (red dot) of a position or group of positions experiencing the dangerous post-climax phase of a GSE

and Joint GSE, respectively. The lower left-hand illustration (purple circle) depicts the approximate state (purple dot) of a position or group of positions experiencing the healing

post-surge phase of a GSE and Joint GSE, respectively.

Individual Risk Tolerance Drives Risk Management Discipline

The most important aspect of the post-PC risk management framework is that it represents a risk discipline that is fundamentally driven by a set of conditional risk management rules which themselves

are uniquely determined by the individual risk tolerance of the post-PC portfolio owner.

In the previous section, we presented a simple set of conservative risk management rules. However, the framework itself is not limited to simple rules. That is, the risk management rules embedded in

the lattice structure of the risk management framework do not have to be simple, nor to do they have to be conservative. In fact, depending on the risk tolerance of the individual who owns core and

non-core post-PC equity positions, the risk management rules may be quite complex and aggressive.

We employ conservative and non-complex risk management rules when managing Cyclefund core and non-core portfolios because global surge events and the more pernicious joint global surge events are

fast-moving and inherently highly asymmetric price change events, where consistent upside gains are far less likely than precipitous downside losses late in a GSE or Joint GSE cycle.

The Late-Cycle Danger of Global and Joint Global Surge Events

Late-cycle GSEs and Joint GSEs are inherently dangerous from an asymmetric risk perspective due to the disposition, behavior, and structural composition of the actors intimately involved in

buying and selling individual equity positions. Conceptually, actors include deep value investors, value investors, growth investors, momentum investors, and long/short traders. Deep value and value

investors typically represent the most conservative and long-horizon actors. In contrast, momentum investors and traders typically represent the most aggressive and fast-moving (short-horizon)

actors.

During the late-surge phase of a GSE or Joint GSE, the only actors bold or irrational enough to hold high-flying post-PC equity positions are late-stage growth investors, momentum investors, and

long/short traders. All other more conservative long-horizon deep value, value, and growth investors have long since moved to the sidelines. The lack of participation from conservative long-horizon

investors results in a highly tenuous structural market composition analogous to a large glass house (momentum investors and traders) without a sturdy metal frame (growth investors), a strong cement

foundation (value investors), and solid bedrock elevation (deep value investors).

When the Earth Shakes and Glass Houses Fall

In this deeply tenuous structural state, any exogenous economic or geopolitical shock that causes market and individual equity volatility to spike increases the likelihood of a late-surge GSE or

Joint GSE transitioning into a dangerous post-climax lifecycle phase, analogous to our aforementioned glass house beginning to fracture when the earth beneath its foundation begins to shake.

During the post-climax phase of a GSE or Joint GSE, the remaining fast-moving, short-horizon momentum investors and traders become increasingly skittish with rising volatility and exit completely or

rapidly reverse their long positions and go short en masse. The resulting selling forces overwhelm any remaining late-stage buyers and the resulting precipitous price declines become untenable for

almost all actors to withstand, causing our conceptual glass house to splinter and fall with little

warning.

The ensuing post-surge phase typically plays out over an extended recovery period or until

prices decline significantly enough to become attractive to the more conservative investors who have long since moved to the sidelines specifically to avoid the shocking, unsettling, and destructive

aftermath of an unchecked global surge or joint global surge

event.

About Cyclefund.com and Cyclefund

Cyclefund.com is a privately sponsored financial literacy and education resource available via the Internet to pre-retired and retired investors around the world who seek to directly manage

their personal wealth. Cyclefund is both a fund-of-funds and a strategic investment theory, with the Inocle Fund or iFund its first publicly published

fund, the Five Cycles Model its first publicly published strategic investment theory, the Apple iPod Post-PC Case Study its first publicly published application of the theory to an

individual product cycle, and the Apple iFamily Post-PC Case Study its first publicly published application of the theory to a suite of interdependent product

cycles.

Accessing Cyclefund.com Using Google Products and Cloud

Services

Cyclefund.com is specifically designed to be easily and quickly accessible to investors worldwide via post-PC devices (wearables, smartphones, tablets, and smart TVs) and

non-post-PC devices (notebooks, laptops, and desktops). The site leverages the power of Google Translate, Search, and Image Search products and cloud services to

accomplish these goals and enhance the site's overall user experience for international users, power users, and casual users, respectively.

International users who visit cyclefund.com from countries around the globe may wish to automatically translate the site's English language content to their own native language and may do so

instantaneously via Google Translate.

Power users of cyclefund.com who seek a detailed understanding of the site's investment theories, case studies, or innovation concepts may wish to recall a specific page, section, paragraph,

or sentence from the site or one of its sisters sites, inocles.com or incole.com, and may do so immediately by typing specific phrases into Google Search.

Casual users of cyclefund.com who prefer to learn about financial and technological concepts through visual images more so than, or in combination with, written text may wish to quickly

access a key diagram, illustration, framework, roadmap, or portfolio and may do so easily by typing in specific keywords into Google Image Search.

Cyclefund Web-First Publication Model

Cyclefund exclusively employs a web-first publication (WFP) model to introduce and release Cyclefund intellectual property. Under the WFP model, Cyclefund

original content, including original text, original images, and associated reference links, is published to the Internet first, before any other form of publication media, such as academic

papers, newspaper columns, journal articles, magazine articles, newsletters, or books.

The primary benefit of this exclusive web-first publication approach is that it enables Cyclefund international users, power users, and casual users around the globe to access all newly

released Cyclefund content immediately and at zero cost.

We strongly believe that the global-reach, immediate-access, and zero-cost advantages of the web-first publication model versus more traditional publication models will

result in the WFP model becoming the dominant approach

for distributing and circulating new conceptual ideas

and educational intellectual property over

time.